- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #182: 🚫 Two recent investments that showcase DSGCP's Anti-AI thesis

Deepak's Musings #182: 🚫 Two recent investments that showcase DSGCP's Anti-AI thesis

🤔 The innovator’s dilemma applied to CPG: Buying early disruption vs defending old playbooks

I'm passionate about exploring every facet of consumer and insurgent brands. Through my newsletter, I curate insights from my reading, analysis, and personal reflections on the evolving brand landscape. Connect with me on X at @dishahdadpuri or follow DSG Consumer Partners at @dsgcp for ongoing conversations about brands reshaping markets.

p.s. You can click any summary link to read the full article from its source.

Secret Alchemist, a DSG Consumer Partners portfolio company

🔮 Resharing the last post of 2025: 10 Things DSGCP is Excited About for Insurgent Consumer Brands in 2026

At DSGCP, we have spent over a decade backing the founders who are reshaping how consumers eat, live, and care for themselves across India and Southeast Asia. As we look towards 2026, the "insurgent" playbook is evolving. It is no longer just about being digital-first; it is about being human-centric, culturally resonant, and structurally resilient. Full post at https://www.dsmusings.dsgcp.com/p/dsmusings181

🧳✈️ WanderOn: One example of a brand that fits into DSGCP’s Anti-AI thesis

This is 𝐭𝐡𝐞 𝐟𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐭𝐫𝐚𝐯𝐞𝐥 and a great example of a business that fits our Anti-AI thesis. As screens take over, DSG Consumer Partners is rooting for the brands that actually want us to leave the house.

Watch the video! You will love it.

🎤🎸 Creation Collective: Another Anti-AI thesis partnership

This partnership exemplifies DSG Consumer Partners’ 2026 Anti-AI thesis by investing in irreplaceable, offline human experiences: live music, cultural connection, and physical presence. Experiences that cannot be automated, synthesised, or meaningfully replicated by AI. In an increasingly AI-driven world, we see the experience economy gaining new significance: the irreplaceable value of human connection and shared moments. Live entertainment is the purest expression of this thesis.

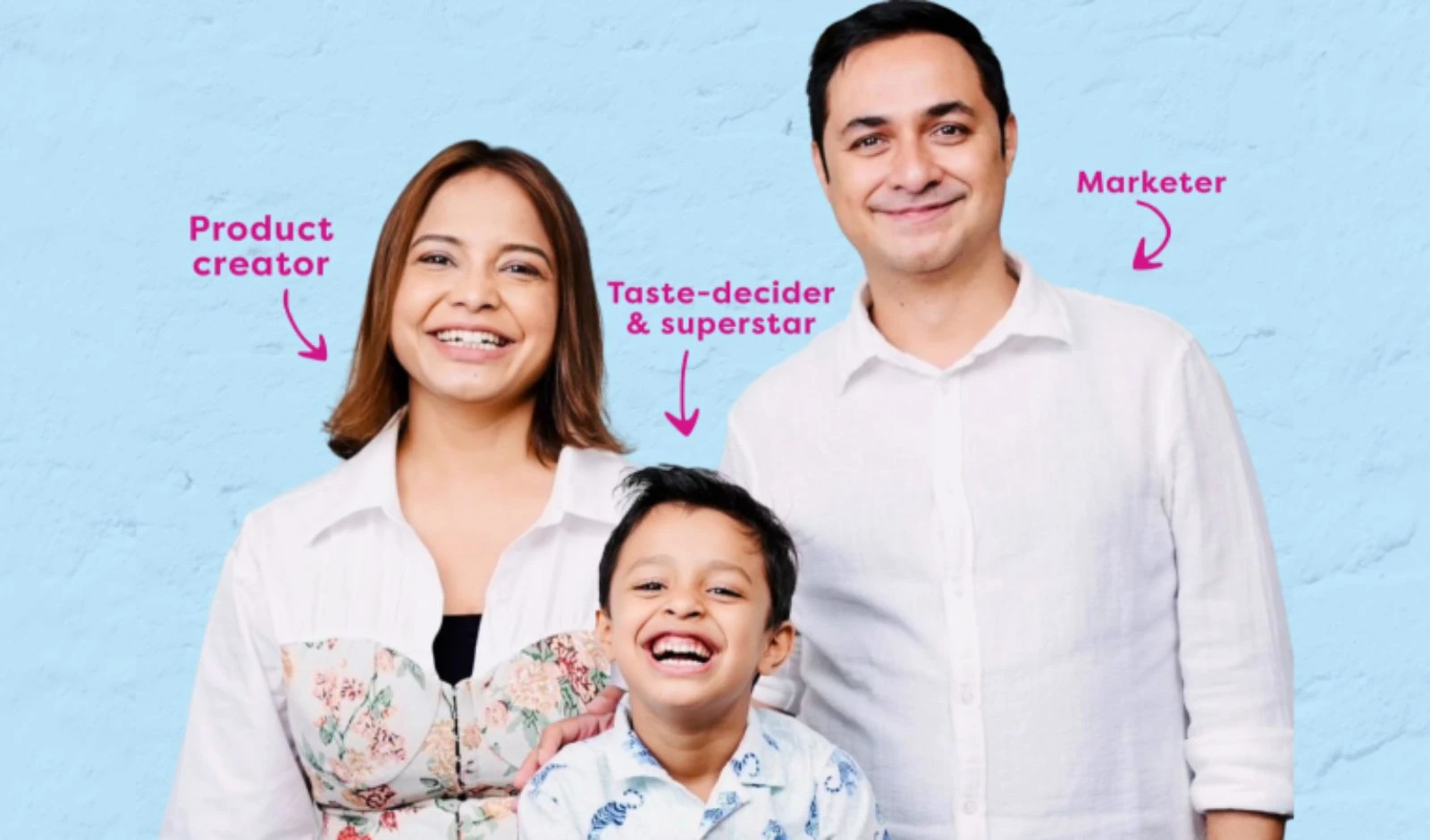

⚱💨 Secret Alchemist: Building India’s first clean perfume brand

I remember my first meeting with Ankita Thadani and Akash Valia. Sadly, Samanta could not join; It would have been a fantastic opportunity for a selfie 😉 (I recently discovered Amazon show The Family Man and just finished season 2 where she plays the main antagonist).

In an industry built on opaque proprietary blends and unregulated ingredients, Secret Alchemist is shattering the status quo as India’s first clean fragrance brand. The brand tackles the "longevity myth" of clean perfumes by leveraging 35 years of aromatherapy expertise and a 25% oil concentration.

Read our memo on why we invested and discover how they are bridging the gap between luxury transparency and mass-market accessibility, creating a new standard of trust in the Indian fragrance market.

⚖️ What the Tiger Global-Flipkart tax verdict means for investors

My mobile kept buzzing, but I was in meetings, so I did not answer. Two hours later, when I checked my mobile, there were 7 missed calls from 4 of my LPs. One question: What are the implications of the Supreme Court of India’s judgment for our past investments?

The Times of India does a great job of summarising the background, history, and implications. When the Supreme Court upended long-standing international tax norms, it may have scored a short-term revenue win, but the broader consequences could be far more damaging. This retroactive reinterpretation of tax treaties and the erosion of predictable cross-border rules risk driving global capital away, raising the cost of investment for Indian businesses and slowing economic growth.

For now, we have to wait and see how the government and tax authorities will use this judgment to open new cases and reassess old closed cases. What we need is clarity so that investors can plan and know what to expect. That will take time.

🤔 The innovator’s dilemma applied to CPG: Buying early disruption vs defending old playbooks

Since the start of the year, I have had very interesting meetings with senior members of the CPG ecosystem, spanning start-ups, domestic leaders, global MNCs, buyout and private equity investors, consultants, and investment bankers.

There seem to be two polarised POVs emerging today: protect the core vs. buy into the disruption.

This reminds me of The Innovator’s Dilemma, the Clayton Christensen book I was given to read when I got my first job in VC in 1999 (yes, I have been doing this for almost 30 years, and I still make tons of mistakes).

The innovator's dilemma in a nutshell: Do you bet on the cash cow that built your headquarters, or the insurgent startup that's plotting to take away your market share? Here's the twist: sticking with what got you here feels safe because it's comfortable. But for CPG giants, loyalty to yesterday's brand/playbook is often the highest-risk move of all.

Let me give you two case studies.

Case study 1: Yoplait vs Chobani

The Yoplait case study highlights what happens when "protecting the core" becomes corporate religion. General Mills owned 40%+ of the U.S. yogurt market with their low-fat, high-sugar playbook. When Chobani launched thick, high-protein Greek yogurt in 2007, Yoplait dismissed it as a niche. By the time they recognised the permanent shift toward cleaner/functional food, they were years behind. Market share collapsed from over 40% to under 20% by 2017. Then they panicked, launched fake "Greek-style" products thickened with concentrates, triggering lawsuits and destroying brand equity. The Chobani story was one reason why DSGCP backed Rohan Mirchandani when he started Epigamia in India.

Case study 2: Marico

True resilience lies in funding the future while optimising the past; you can’t afford to let your heritage brands become hostages to a changing market. Marico is a case study in self-awareness: they saw their moats (Parachute and Saffola) turning into cash cows and decided those cows should fund the future. The last decade has been about transformation, pivoting from old-school FMCG to building a portfolio of next-generation insurgent brands. Kudos Harsh Mariwala and Rishabh Mariwala.

I believe large MNCs need to look at what Marico is doing. Keep working on and improving your core, but see insurgent brands as the future and partner with them. And sometimes you acquire them. That investment in a young brand early will teach you so much.

Reply