- Musings From Deepak @ DSG Consumer Partners

- Posts

- Musings From Deepak @ DSG Consumer Partners #109

Musings From Deepak @ DSG Consumer Partners #109

All things consumer & insurgent brands. What I am currently reading, thinking about, and reflecting upon. You can follow me on Twitter at @dishahdadpuri or follow DSGCP at @dsgcp.

India's CPG companies see recovery in volumes and margins

We are seeing the same at our portfolio companies but I do not see most, if any, CPG companies reduce prices.

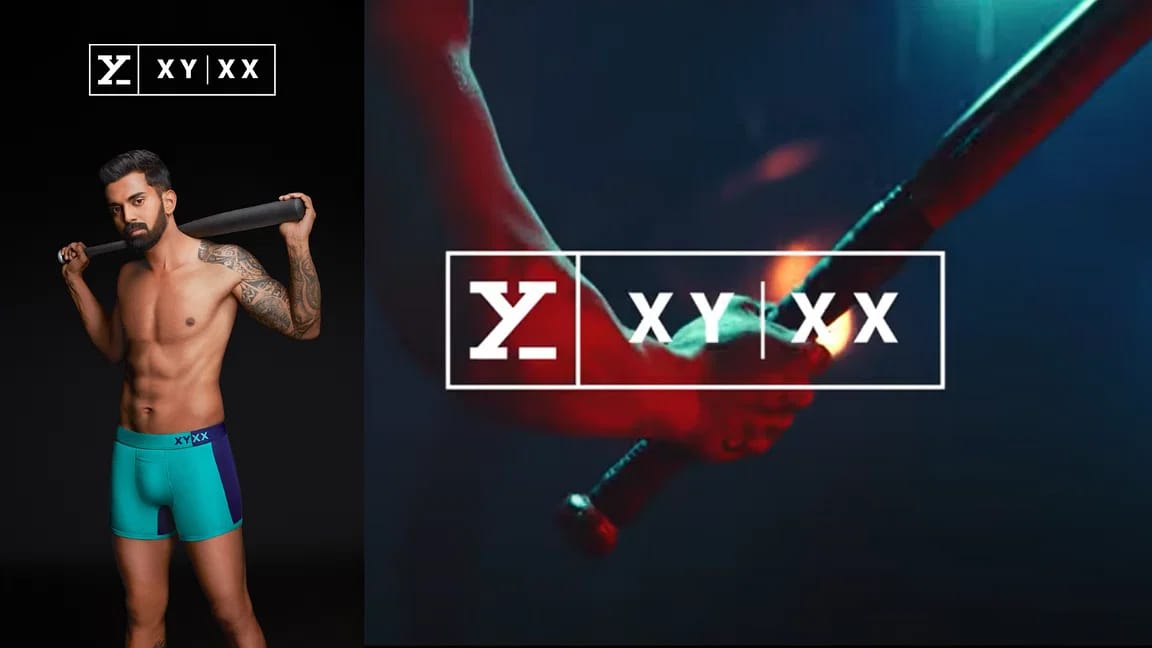

Amazon leads latest funding round at DSGCP innerwear portfolio co XYXX

CEO Yogesh Kabra speaks to CNBC about the funding, the problem XYXX is solving and expansion plans.

☕ ☕ Nestle is excited by the new coffee culture brewing in India. So are we at DSGCP. Not only in India but in Southeast Asia too.

DSGCP has been tracking the coffee category in India and SEA for over a decade now. To date, we have made two direct investments in this space: Sleepy Owl in India and Pickup Coffee in The Philippines. We believe that markets like India will see increased penetration and other markets like Singapore and The Philippines will continue to see growth in per capita consumption.'

RTD Cocktails - Trend or Fad

This is something we have been debating internally. We can see a market for the consumer market but does it work for B2B? What is your view?

🍸🍸 Are RTD cocktails a long-term trend or just a fad |

Pip & Nut X Butternut Box

I love it when brands think of out the box and do fun stuff together. This time it is DSGCP portfolio co Pip & Nut and fresh dog food co Butternut Box.

Plant-Based: The Hype Cycle

I am surprised that people are surprised by the current disillusionment around plant-based products. This is what was expected and part of the evolution of any new market or technology. This is known as the hype cycle, first developed by Gartner to explain cycles in the technology sector. We have been using it at DSGCP for decades and it encapsulates how new category creation work. Innovation always leads to crazy expectations (just think back to the valuations of Beyond, Impossible, Next Gen, etc that were valuable like software companies). This then leads to disillusionment which is the current state of the market today. Slowly we will find a baseline and I believe that this category is here to stay and will continue to grow over the next decade.

Reply