- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #179: 🛍️ How should an insurgent brand founder approach AI?

Deepak's Musings #179: 🛍️ How should an insurgent brand founder approach AI?

֎ More on AI: The future of Agentic Commerce

I'm passionate about exploring every facet of consumer and insurgent brands. Through my newsletter, I curate insights from my reading, analysis, and personal reflections on the evolving brand landscape. Connect with me on X at @dishahdadpuri or follow DSG Consumer Partners at @dsgcp for ongoing conversations about brands reshaping markets.

p.s. You can click any summary link to read the full article from its source.

⚱💨 L'Oréal pays €4bn for Kering’s BPC division

What is L'Oréal buying?

The core asset is the Creed fragrance franchise, which Kering acquired just 2 years ago for €3.5bn. It also gets 50 year licenses for the other L’Oreal also gets the license for the other Kering brands: Gucci (licence to 2028 with Coty), Balenciaga, Bottega Veneta beauty and more.

According to Jeffries, the key numbers for the deal are revenue of €800Mn, EBITDA of €300Mn, and operating profit of €280Mn.

At €4.0bn, this will be L'Oréal’s largest deal ever.

Most interesting for me?

That, as part of the agreement, L’Oréal and Kering will also create a 50/50 joint venture to explore opportunities in wellness and longevity. Kering has always been associated with luxury. L’Oréal with beauty. The focus on longevity is the key.

💅 Gen Zs are not buying into products, they are buying into brands - Nadine Graf of Estee Lauder

I enjoyed this piece in the latest edition of Fortune India on why it is so hard for a brand to succeed and remain loyal in the BPC category, especially amongst Gen Zs. Nadine summarises it well when she says that the retail landscape is undergoing an unprecedented transformation driven by Gen Z consumers, who prioritise brand values and purpose over products alone. While efficacy and safety remain essential, Gen Zs demand emotional relevance and authenticity, seeking brands that align with their communities and values. 100%!

🐮 The Chobani story

For a company founded in 2005 and launching its first product in 2007, Chobani has come a long way. Some would say a very long way. Last week, it announced it raised $650mn at a $20bn valuation.

I have been watching Chobani since 2010, when I first discovered it at a supermarket on a trip to the US. I loved the product! And it was protein-rich. Many years later, I had the opportunity to partner with the late Rohan Mirchandani and Verlinvest’s Arjun Anand to incept a brand that would become India’s Greek yoghurt pioneer. That brand is Epigamia.

As I gaze into the crystal ball, I am thinking about what Epigamia can learn from Chobani’s success and mistakes to build a leading insurgent brand in India. Excellent case study I stumbled onto last week, below, with a lot of details about the Chobani story.

Coincidentally, I was listening to a podcast featuring the founder of Chobani, which I think is a must-listen for anyone building a mission or purpose focused brand.

🇮🇳 India is a bright spot for CPG brands

India is becoming the growth engine that big CPG can’t ignore. Nestlé and Reckitt both singled out India as a “bright spot” on recent earnings calls. Nestlé highlighted strong momentum, while Reckitt called out short-term GST phasing but steady demand.

🤝 What does Kirin’s sale of some of its alcobev assets tell us?

Kirin was advised by UBS, an international investment bank, to sell Four Roses and focus more on adding health care companies. In Japan, alcohol volumes and drinking rates have been sliding for two decades (so much that the tax agency campaigned to get young adults to drink more), while no/low-alcohol and broader “health & wellness” categories are growing faster and carry attractive margins.

🛍️ How should an insurgent brand founder approach AI?

Bain & Company’s latest brief on CPG and AI is insightful. The takeaway is simple: AI lets small consumer brands outrun the giants by moving faster and learning quicker. Use it to spot what shoppers want quickly, whip up product ideas and packaging in days, launch tiny test runs, then double down on winners and cut losers early. If you’re building a brand, this guide shows how a scrappy team can beat the big guys. For those who follow DSGCP, in particular our AI Sprints, you will know that we are working with our founders to understand better the vast array of AI tools and how to integrate them into our daily workflows.

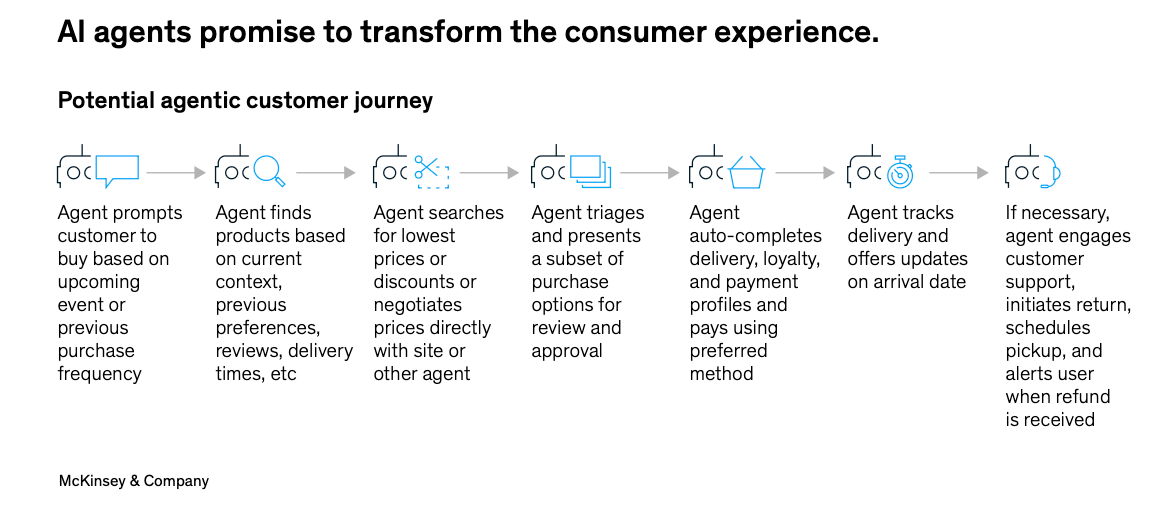

֎ More on AI: The future of Agentic Commerce

I tell each founder I meet the same thing. Even after you have the product or service everyone wants, how do you get discovered and then get them to try it? Once there is a trial, we move to repeats and growth. Discovery and trial have always been hard to crack, but some playbooks work.

But if AI agents are going to be making those decisions, how do we, as a brand, get discovered and chosen by them?

This report from McKinsey suggests that if you are an insurgent brand startup, you should be built for agents first: make your catalogue “agent-readable” and expose it via stable APIs so shopping agents can compare, assemble carts, and check out.

The full report is available on the McKinsey & Company website.

💩 Would you buy a poop-tracking device to complement your Oura or Whoop?

Would you spend up to US$600 on a Dekoda or Throne? Maybe you will wait till there is a made-in-India version. Something for Ultrahuman to think about?

Let’s do a poll.

Would you buy a poop-tracking device as part of your longevity routine? |

👓 Everyone is watching Lenskart

Lenskart is the story of a successful insurgent brand. Lenskart hacked India’s eyewear market with vertical integration, fast design cycles, and an omni-channel rollout that now spans 2,700 stores and FY25 revenue of ~$755M with 70% gross margins. With its DRHP filed, Lenskart is poised to become India’s first pure-play eyewear listing and, more importantly, another case study of an insurgent brand graduating to the big leagues.

For me, as a business, this is a super opportunity in an unorganised, unbranded category (excluding the premium end where it is branded). But I will leave it to the analysts and Investment Bankers to determine how to price the shares today, and to the fund managers who will buy them.

CNBC TV-18’s Mangalam Maloo spoke to CEO Peyush Bansal and CFO Abhishek Gupta post the DRHP filing. Lots of nuggets.

☕ Is this coffee

WTF - An iced latte with coffee made without beans, milk without cows, and protein produced from thin air.

I am going to check out GRe:en Drop Coffee tomorrow.

Reply