- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #149 Why most DTC businesses fail and the 13 sins to avoid

Deepak's Musings #149 Why most DTC businesses fail and the 13 sins to avoid

🚀 Case study: Buzzballz Drinks

Good morning from Geneva. I am in Europe this week, meeting CGP investors, both GPs and LPs. As a collective, we are trying to better understand how we help insurgent brands launch, scale, and succeed.

I am interested in all things consumer and insurgent brands. In my newsletter, I share what I read, think about, and reflect upon. You can follow me on Twitter at @dishahdadpuri or DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

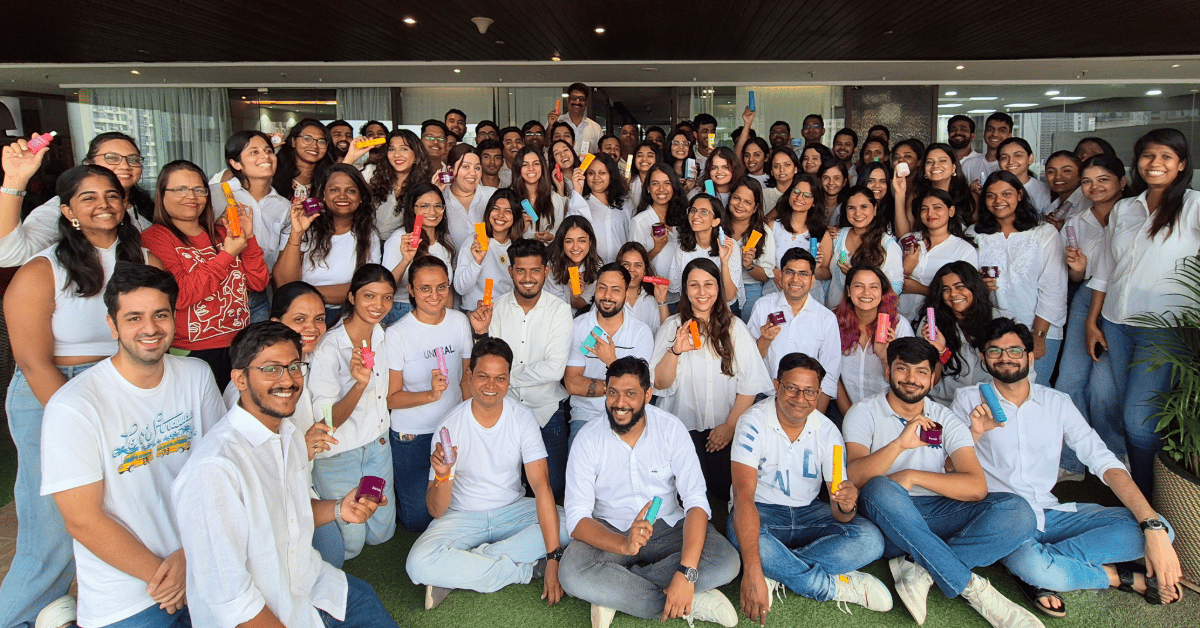

Shantanu Deshpande, Akhil Kansal and Kuldeep Parewa

🇮🇳 India Elections 2024: Modi 3.0

Overall, the elections were marked by high voter turnout and a competitive atmosphere, reflecting the evolving political landscape in India. Below is our one-page TLDR.

💄 India’s BPC category attracts local and global investors

Recent deals in the category include Purplle, Foxtale, MCaffeine and Traya.

🚀 Case study: Buzzballz Drinks

In 14 years since she founded the brand, founder Merrilee Kick has built BuzzBallz into an alcohol industry powerhouse. In addition to distribution across the United States, the brand is now sold in 29 countries, and its annual revenue, according to Forbes, is roughly $500 million.

💀 Why most DTC businesses fail and the 13 Sins to avoid

Long but worth a read for anyone working in or with insurgent brands. Frederic Fernandez has distilled his learnings working with FMCG brands over the last 7 years into five key messages.

1. Hype to deception

2. Limited success stories (so far)

3. A large part of the $100Bn DTC assets are underperforming

4. The 13 sins killing a DTC business

5. Winning requires a rigorous omnichannel, consumer-centric, and financial approach

🍽️ Are restaurant groups the new chain?

Given the current environment, I am unsurprised that many new restaurants are part of a larger group. They may be one-off brands or stand-alone but enjoy some scale benefits of being part of a larger platform. I have seen this more regularly over the last decade in Singapore and India. Some examples include Unlisted Collection and Lo & Behold Group in Singapore and Hunger Inc and Impressario Holdings in India.

👃 Whole-body deos anyone?

Did you know that humans have two kinds of sweat glands, Apocrine sweat and Eccrine sweat, and their products differ? Also, please remember that deodorants and antiperspirants aren’t the same. What is the market opportunity?

💈 Portfolio spotlight: Anveshan on The Barbershop

Shantanu Deshpande of The Barbershop, speaks to Anveshan’s Akhil Kansal and Kuldeep Parewa about the company’s journey and plans for the future. DSG Consumer Partners first partnered with the three founders in February 2021 and are privileged to be part of their brand journey.

Launchmetrics latest study found that collaborating with authentic Gen Z influencers is vital for cultivating connection. Gen Z has an appetite for comfort and ease, and tapping into values that matter is key, such as sustainability and inclusivity.

💡 38% of Europeans aged 25-35 have tried a new product because it is more innovative and better than other products

Circana’s 2024 New Product Pacesetters report showcases 2023’s top-selling new CPG products, providing insight into changing consumer behaviours. As consumers adjust to busy post-pandemic lifestyles, products promising easy meal solutions and elevated breakfast routines are in high demand.

⚡ Is Q-commerce the future of online grocery for India?

Ruchira Jain, founder of Elevate Insights (and a former Swiggy VP), argues that it is.

📰 Select funding & deal news

Funding and deal news that caught my attention this week

Reply