- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #139: DSGCP's 2024 Sustainability Report

Deepak's Musings #139: DSGCP's 2024 Sustainability Report

This year, we are proud to showcase the strides of Blood, GO DESi, Anveshan, Ugaoo, and Coolmate in building responsible business practices.

All things consumer & insurgent brands. What I am currently reading, thinking about, and reflecting upon. You can follow me on Twitter at @dishahdadpuri or follow DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

🌱💚 DSG Consumer Partners’ 2024 Sustainability Report

While consumer awareness about sustainability is growing, there remains a noticeable say-do gap, with few willing to act on their concerns. "Good value for money" remains the top purchasing driver, reflecting SEA consumers' price sensitivity. Despite the importance of being environmentally friendly and purposeful, these factors rank lower in consumer considerations. It's clear that businesses must meet ESG standards while also prioritizing key table-stake elements to remain competitive.

This year, we are proud to showcase the strides of Blood, GO DESi, Anveshan, Ugaoo, and Coolmate in building responsible business practices.

🥨 An insight into one of Malaysia’s fastest-growing CPG companies

I grew up in Singapore in the 70s snacking on Mamee. My 3 kids (17, 15 and 10) also love Mamee. It is an iconic brand in Malaysia and Singapore.

I only met Pierre for the first time in 2023. He was introduced to me by a mutual friend Darren Tan of Apricot Capital. Mamee had recently acquired a controlling stake in one of our portfolio companies The Golden Duck.

🌎 The need to localise even for global brands

The top-selling flavours for Maggi are from India and Indonesia and local flavours are adapted to each market. I am also seeing this across categories from yoghurt to savoury snacks (I love Lay’s magic masala) to RTE to QSR. With a large percentage of the sales growth coming from new and emerging markets, brands must step up to the plate and adapt quickly as insurgent local brands are often already in the market with a more authentic story.

📟 Mswipe raised $20M in latest funding

I have been on the board of MSwipe for 10 years and have worked closely with Manish and Patel as they are building one of India’s most robust payment solutions companies, starting with the humble mPOS machine and with the recent grant of the payment license to become a full-service platform.

🛒 Britannia explore various GTM strategies to enter new premium consumer categories

I am curious if they will consider acquiring insurgent brands in some of the categories they are looking at. Given certain pockets of strengths and moats, I would think Britannia has the right to leverage those assets with new brands in premium categories. We shall see.

👄 What is lip oil and why is it on trend?

I learnt something new this week. Lip oil. Here is a 101 on lip oil and why it is taking the beauty market by storm.

Is the CBD trend reversing?

Until there is clarity of regulation, CPG companies are not going to invest too much in CBD-based products.

🍷 Building a CPG brand takes decades not years

This story was in the 1 Mar 2024 INSEAD #LifelongLearning newsletter. It is a piece I contributed to in 2009. Yes 15 years ago. I had invested in Sula Vineyards in 2005, partnering with Rajeev Samant, who wanted to build India's most loved wine brand.

Fast forward 15 years. It is now 2024. Rajeev took Sula public in Dec 2022 and the company has a market cap of US$600 million.

This case study has so many lessons for me, as a VC, for Rajeev as a founder, and for all entrepreneurs who have the conviction and wisdom to work hard to take advantage of what the next 20 years will bring for the Indian consumer. We are just getting started.

Looking at Sula, their headroom is immense given that even after 15 years less than 2% of Indians drink wine. Another key lesson for 1st time entrepreneurs: you do not need to look at exports. India is a huge market.

👜 India’s luxury market

S&P Global has projected that India will become the third-largest economy in the world by 2030. With this Indians are getting wealthier. The next 20 years are going to be very exciting for premium and luxury brands. Indians may look for “value” but they love premium and luxury products.

But as we all know, Indian spending patterns differ from the West and even from other Indian markets.

Worth reading this piece from German consulting firm Simon-Kucher as they look at what it may take to win in this space.

Whilst we are on the topic of premiumisation and luxury, have you seen what has been happening in India’s rum market? Anyone who has grown up or lived or spent time in India, and is not a teetotaler, would have tried Old Monk. Old Monk’s market share has been falling over the last 20 years for a variety of reasons.

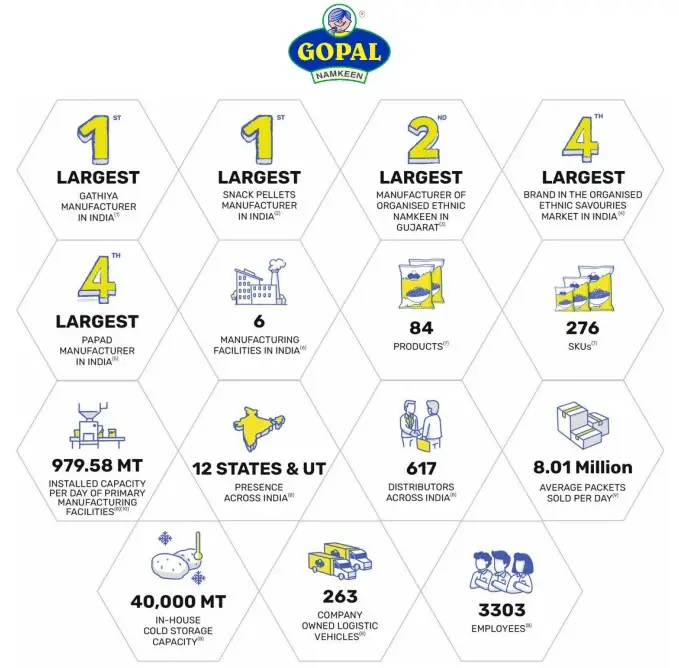

CPG IPO: Gopal Snacks to go public next week

I will be watching this closely. Like Sula, this is an offer for sale (OFS) by existing shareholders with no new shares being issued given that the company is profitable and management claims they are fully funded. I am curious to see how it will be priced and how institutional investors receive it. At the top end of the price bank, this will have a 5,000Cr (US$600m) market cap.

Gopal Snacks is a fast-moving consumer goods (FMCG) company in India with a major presence in Gujarat

Select funding & deal news

Funding and deal news that caught my attention this week

.png)

Reply