- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #129: When should an insurgent brand think about exports?

Deepak's Musings #129: When should an insurgent brand think about exports?

All things consumer & insurgent brands. What I am currently reading, thinking about, and reflecting upon. You can follow me on Twitter at @dishahdadpuri or follow DSG Consumer Partners at @dsgcp.

p.s. You can click on any of the summary links to read the full article from its source.

🌎 When should an insurgent brand consider exporting?

Tldr: Moving too early can stretch a company too thin. Critical for insurgent brands to thoroughly assess their readiness and the market conditions before venturing into exports.

The story below is about an insurgent ice tea brand but what got me thinking was the fact that “the firm is looking to enter mass-market retailers in India by 2024, and currently in talks with distributors from the Middle East and South East Asia to launch the product for export around the same period”.

With a domestic market as large as India, when does an insurgent brand earn the right to export? It is hard to build a brand in one’s home market and even harder to do it regionally in India. Doing justice to a brand in an export market is very hard.

I remember BOD discussions at Veeba and Sula in the early days. And the consensus wisdom was that you have to be a profitable business with a strong brand before you earn the right to consider export. For example, Veeba only started exporting when it was 9 years old and doing $100m in revenue.

I have an old-fashioned view. If you could grow at a strong CAGR in your home market, it could be India, Indonesia or Vietnam, why do you want to go through the pains of building your brand in a new country? Singapore is an exception to the rule, given the tiny size of the domestic market, so most brands have a view of using the city-state as a springboard to building a broader brand, as we did at SaladStop!.

Don’t forget markets like India or Indonesia or Vietnam or the Philippines are huge. Get to a large market share and demonstrate you have the right to win in your home market, before thinking whether you have a right to play in an export market. You could easily burn a lot of cash in your adventures to conquer the world.

Keep in mind, that consumers are different with different preferences, tastes and nuances.

🏅 7 DSGCP portfolio companies on Inc 42’s list of brands disrupting India’s consumer market 2023

Congratulations to 82°E, Arata, Koparo, Power Gummies, Supe Bottoms, The Moms Co, and XYXX.

I am treating this as a list of insurgent consumer brands. The label D2C is misleading. Many of these brands are not D2C. And D2C is just a channel!

🪒 How big is the men’s grooming opportunity in India & Southeast Asia?

Based on what I am seeing in India and SEA, we haven’t even got started yet.

🚀 Honasa Consumer firing on all cylinders

A fantastic set of numbers! For the September quarter, Honasa reported a 21% growth in topline to ₹496 crore, while EBITDA or Earnings before Interest, Tax, Depreciation and Amortisation grew by 53.5% to ₹40.3 crore. The company's EBITDA margin also grew by 170 basis points to 8.1%. Underlying volume growth for the quarter stood at 27%.

🍻 Is Craft Beer in a crisis?

Many craft breweries have not survived the last 10 difficult years. In this story, The Grocer looks at the UK craft beer market and asks how craft beer can stay interesting and relevant. I am a big believer in the category, and we are just getting started in India and Southeast Asia. Drinkers want a better liquid.

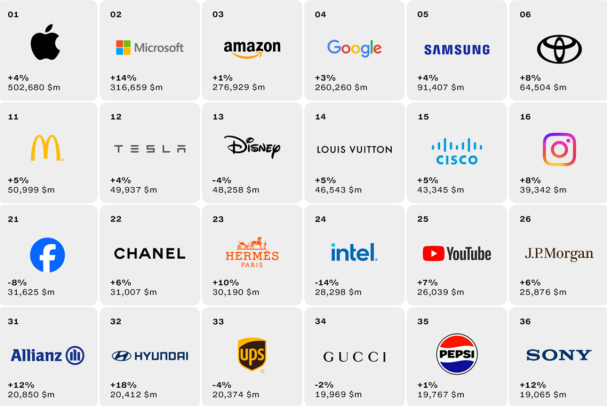

👄 Highlights from the latest Interbrand Best Global Brands Report 2023

Some very interesting data from the latest report.

Download the full report here: https://learn.interbrand.com/hubfs/Best-Global-Brands-2023-Report.pdf

Reply