- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #126: Too Much Optimism Amid Uncertainty?

Deepak's Musings #126: Too Much Optimism Amid Uncertainty?

And how important is the purpose or mission in a brand’s DNA for its commercial success?

All things consumer & insurgent brands. What I am currently reading, thinking about, and reflecting upon. You can follow me on Twitter at @dishahdadpuri or follow DSG Consumer Partners at @dsgcp.

🇮🇳 India: Too Much Optimism Amid Uncertainty?

Over the last 4 weeks, I have had a chance to speak to a large number of Limited Partners, some of whom are investors in DSG Consumer Partners, and many others who are not. I wanted to share what they are saying and also my POV as I read between the lines.

We were already in a very tight economic environment given interest rates and slowing consumption despite moderating inflation. The conflict between Israel and its neighbours which erupted on 7 October 2023 is the latest issue the world has to deal with. The tragic loss of life and the risks to peace in Israel and Gaza, and the rest of the region clearly are foremost on people’s minds. Our hearts go out to all the innocent civilians caught up in this messy geopolitical issue. This will have significant economic implications as this crisis plays out. Given the uncertainty around this conflict, the LPs were sceptical about the state of the global economy. The Russia-Ukraine war has demonstrated the impact of geopolitical tensions on the global economy. The older and more experienced LPs who were deploying capital during 9/11 in 2001 and when Iraq’s Saddam invaded Kuwait in 1990, talk about how this will lower investment and employment. I am ignoring the broader potential impact of how this will impact geopolitical divisions as China and Russia assess their support. LPs spoke about the possible disruption to trade flows and its consequences. Having said all of this, the financial market reaction to date has been relatively muted.

DPIs are still down with many LPs talking about cashflow mismatch and therefore a reduction in new commitments. All LPs talk about delayed exits as GPs look to optimise pricing. They are not too happy. Cash trumps MOIC.

They expect NAVs to continue to trend downwards in VC funds, as portfolios get marked down from their previous (some used the word “inflated”) highs.

The best businesses will continue to get funded but on multiples that founders will find “painful”. “Multiples used in 2019-2021 are not reflective of the market averages”. “Things will over-correct before they get back to the long-term trendline and we have not reached that point of over-correction yet”. “Sellers are now price takers with buyers, financial or strategic, being very disciplined about who they buy and what they pay”.

Given the above, especially in terms of India, I feel there is too much optimism amid uncertainty. And my gut tells me 2024 is going to be more difficult than most market watchers think. I would be more defensive as we build out portfolio and will advise our management teams across our portfolio, to manage their businesses with a close eye on the balance sheet, and manage growth accordingly. Over the next 2 decades, there is no doubt India will be one of the strongest growing economies but it is going to have a few bumps along the way.

The good news is that over the last two years, many companies have become more disciplined, cut costs, focused on their quality of earnings vs breakneck growth, and have built a very strong foundation. As long as they focus on the long term, they will be well placed to take advantage of the tailwinds that India will have.

🍷 The evolution of India’s wine market

Moët Hennessy (part of LVMH) clearly sees the potential and quality of India's wine-making abilities. Credit must go to Rajeev Samant at Sula Vineyards who has spent the best part of the last 20 years making some of India's best wines and educating Indians, and the world, that India can make great wines.

Ipsita Das says, "We want Aurva to put Indian luxury wine on the world map" but Sula has already done that.

Wine is about many things. Terroir. Craftsmanship. Variety. When I first invested in Sula in 2004, Rajeev and I talked about the future, how India will slowly become a wine-producing and exporting nation and one day attract global winemakers given its unique terroir. That time has come.

I am confident that the Sula wine-making team led by Karan Vasani and Kerry Damskey will continue to take advantage of the terroir and continue to push the boundaries over the next 2 decades.

🍷🍷 Cheers to Sula. Cheers to Chandon. And most importantly, cheers to Indian wine.

🩲 Portfolio update: XYXX

Yogesh Kabra, CEO of DSG Consumer Partners portfolio co XYXX Apparels, speaks to India Retailing about the company's journey including plans to scale from 14,000 physical touchpoints to 30,000 touchpoints.

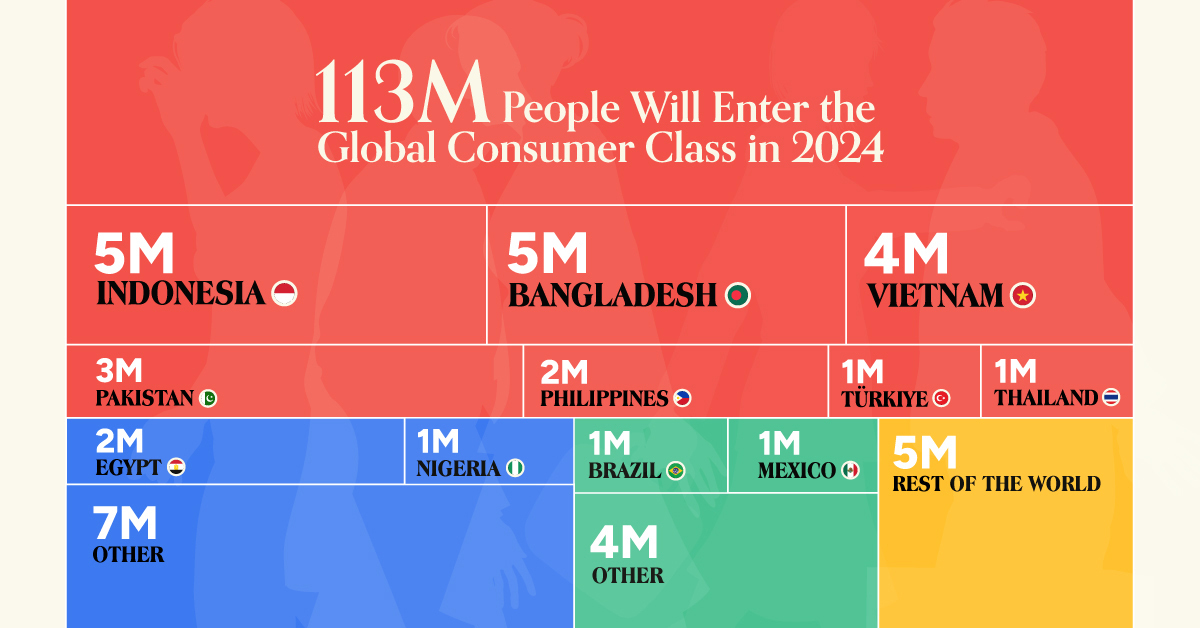

👭🏾 30% of all new consumers in 2024 will come from India

This means 33 million Indians will join the global middle class in 2024. 5 million in Indonesia. 4 million in Vietnam. 2 million in the Philippines. BMI estimates that India's household spending will surpass $3 trillion in 2027 as disposable income rises by 14.6% compounded annual growth until then. Great time to be a consumer entrepreneur building an #insurgentbrand for the consumers in these markets.

🏃♀️ Gen Z’s fitness habits

Gen Z is the largest generation ever and 50% of this survey’s respondents say they’re ready to enter the fitness market, representing a golden opportunity for brands to win new fans.

Access the full report at: https://bit.ly/GenZfitnesstrends

🌱 What do consumers want from plant-based alternatives?

This is a UK-based survey but I argue that the findings apply more broadly. Plant-based companies need to improve taste, and quality and get to price parity to engage consumers.

👜 The future of Southeast Asia’s insurgent brands

Sameer Mehta, Head of Southeast Asia at DSG Consumer Partners, recently moderated a panel at Jakarta's Tech in Asia conference on The Future of Southeast Asia’s D2C Space. It was a wide-ranging discussion with Cindy Angelina of skincare brand ESQA and Andrew Kandolha of eyewear retailer SATURDAYS, where they discussed the Tiktok ban, channel strategy and when to go regional, if at all.

🍶 Company Spotlight: Mamaearth from insurgent brand to IPO

The Q1FY24 numbers are impressive. Net revenue of 464Cr (US$55 Mn) with 8.7% EBITDA. At the lower end of the ₹308-₹324 per share price band, this gives the company a valuation of ₹10,500Cr (US$1.25 Bn). There is a ton of analysis on the pricing, valuation, multiples, and returns each selling investor will make and more on the web and in every Indian financial newspaper.

This IPO is critical for the entire consumer venture capital ecosystem. Very few insurgent brands have gone public. The last one was Sula Vineyards, where I was the first institutional investor. This IPO is being watched by everyone who wants to validate their assumptions about investing in insurgent consumer brands. Full credit to the founders and the early venture backers including Fireside, Sharp Ventures, Titan Capital, Stellaris and later Sofina.

If the IPO goes well and the after-market performance (company and share price) is strong, it will do wonders for the ecosystem as the next generation of founders building insurgent consumer brands will have more than one case study to learn from.

🌍 How important is the purpose or mission in a brand’s DNA for its commercial success?

There is a lot of debate on this topic. As I look back at entrepreneurs pitching their insurgent brand ideas to me over the last 20 years, purpose has become more prominent in their pitch deck and in many brands it is positioned as the core of the brand. But how important is it?

Unilever’s new CEO Hein Schumacher says it cannot apply to all brands.

Quick reader poll on purpose/mission

How important is the purpose or mission in a brand’s DNA for its commercial success? |

How important is the brand's purpose/mission when you buy a product? |

🌱 Portfolio Update: SaladStop! walking the talk

SaladStop!’s B Corp certification reflects its ongoing commitment to creating a positive impact in its communities and ensuring that sustainability remains at the core of its operations by cultivating an ecosystem of aligned suppliers and investors, and climate-conscious customers.

Marketing gimmick or smart strategy?

WNWN, the cocoa-free chocolate startup has launched a portfolio of products “inspired” by some of the UK’s most popular chocolate brands from colours to packaging and more.

Reply