- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #175: 🚀 The Insurgents Brand Playbook 3.0 Game Changers 2025 - The Scaling Blueprint

Deepak's Musings #175: 🚀 The Insurgents Brand Playbook 3.0 Game Changers 2025 - The Scaling Blueprint

🇮🇳 McKinsey’s Vivek Pandit X The Financial Times’ Veena Venugopal

I'm passionate about exploring every facet of consumer and insurgent brands. Through my newsletter, I curate insights from my reading, analysis, and personal reflections on the evolving brand landscape. Connect with me on X at @dishahdadpuri or follow DSG Consumer Partners at @dsgcp for ongoing conversations about brands that are reshaping markets.

p.s. You can click any summary link to read the full article from its source.

🚀 The Insurgents Brand Playbook 3.0 Game Changers 2025: The Scaling Blueprint

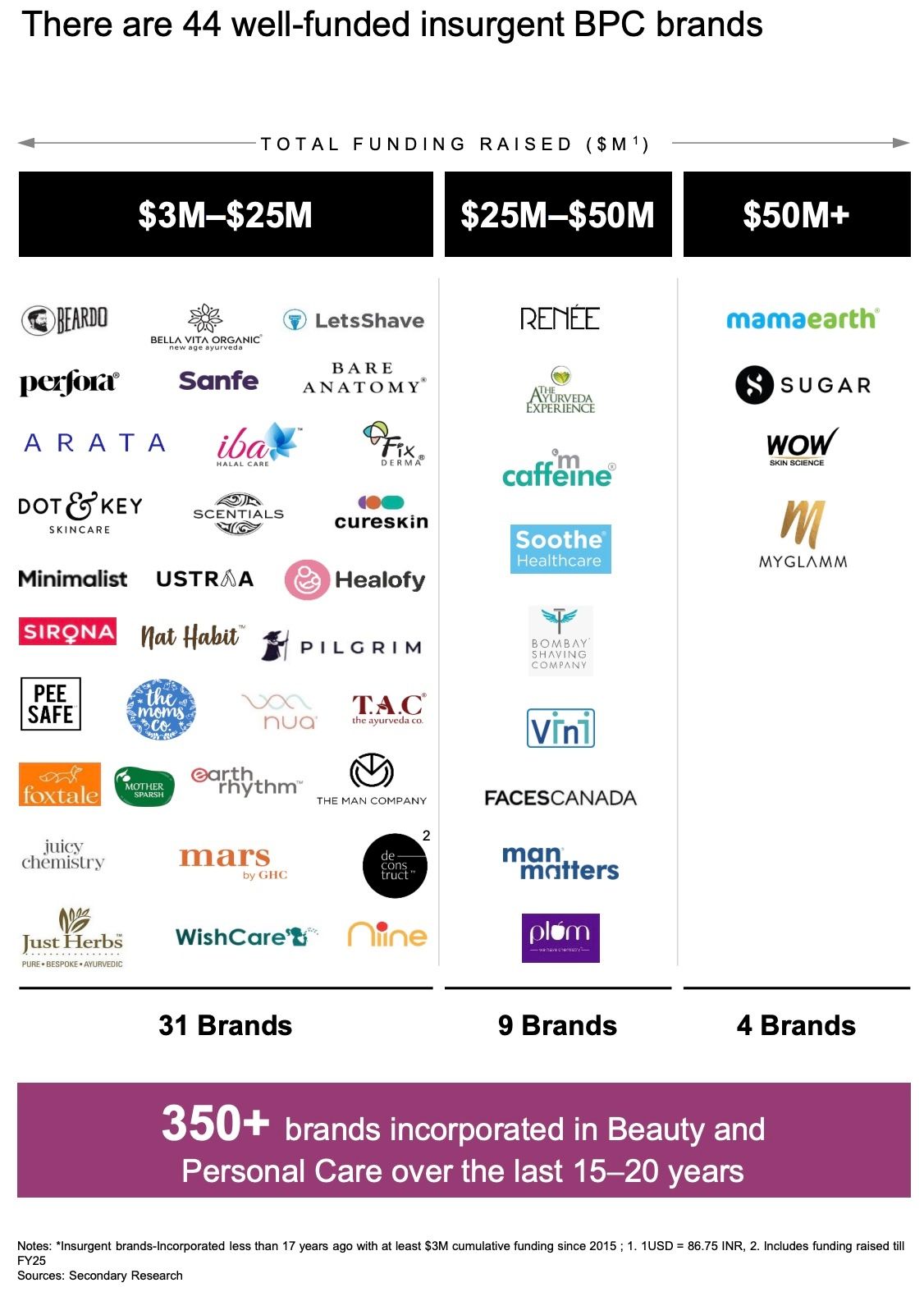

The DSG Consumer Partners and Bain & Company’s Insurgent Brands Playbook may have been designed for insurgent founders, but it’s been just as eagerly embraced by incumbents. DSGCP's Hariharan Premkumar had an excellent conversation with Mangalam Maloo, Ekta Batra, and Vinnii Motiwala on CNBC-TV18 about the latest edition of the Playbook. What’s most encouraging is how broadly the frameworks are being adopted across the ecosystem. Many incumbents are now using them to assess brand health and guide acquisition strategies. That’s beneficial for all: CPG incumbents have long innovated through acquisitions, and these lenses enhance their ability to do so. For insurgents, the core advantages remain unchanged—speed in decision-making and execution, and the ability to win in niche markets.

Link to the Insurgent Brands Playbooks: https://bit.ly/ibp2025

Click on the image to watch the full CNBC interview:

🦸🏻♂️ Who is Rohan Oza?

From Vitaminwater with 50 Cent to Smartwater with Jennifer Aniston, Rohan Oza has long been the secret weapon behind celebrity-backed beverage blockbusters. His biggest bet yet? Transforming a tiny apple cider vinegar drink into Poppi, the prebiotic soda that Pepsi scooped up for $1.9 billion. This piece in Forbes traces Oza’s playbook.

👶🏻 R for Rabbit

As young parents demand safer, smarter, and more stylish options for their little ones, the question looms: will emerging challengers like R for Rabbit reshape the category, or will global giants continue to dominate the nursery aisle?

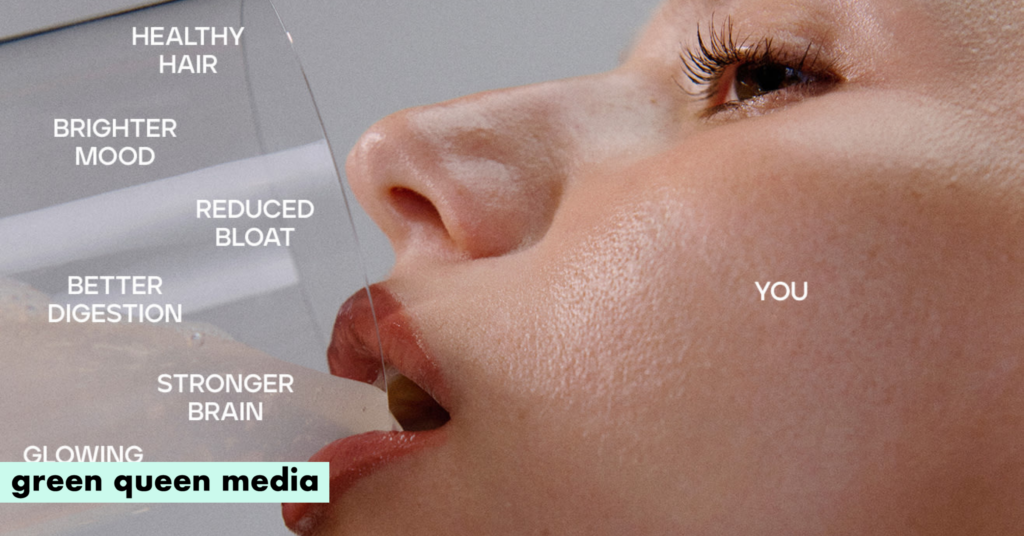

🧬 The massive opportunity in women’s health

From cycle-syncing, plant-based proteins to tailored supplements for the modern Asian woman—women’s wellness is evolving fast. Green Queen spotlights brands pioneering functional nutrition and hormone-aware products. In parallel, DSG Consumer Partners is backing female-centric innovators like Moom, with its personalised supplement rituals, and Smilemakers, with its wellness-forward intimacy designs. Together, these stories highlight a powerful shift: from mass-market fixes to nuanced, science-infused solutions that truly serve women’s health journeys.

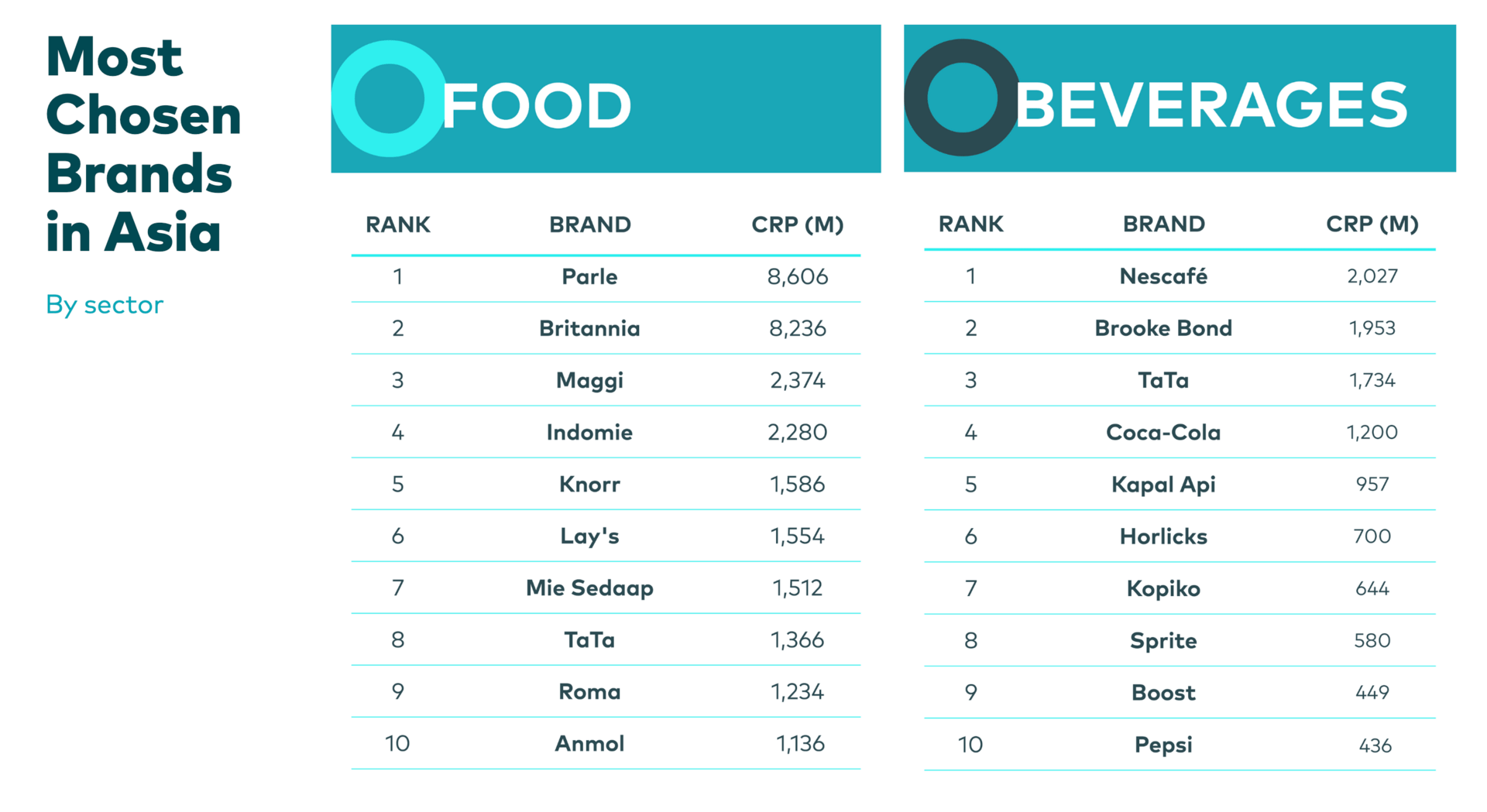

🥇 Asia’s most chosen brands

Worldpanel has just published its Brand Footprint Asia 2025 Report - a ranking of the most chosen FMCG brands across the region. This year’s report analyses over 4,500 brands across 11 markets, uncovering the strategies behind penetration-led growth and the brands that are winning the hearts (and baskets) of consumers in Asia. And the most chosen brand in Asia is India’s Parle followed by India’s Britannia. Three of the top 10 are instant noodle brands!

Link to full report: https://bit.ly/4n1lWsk

Indians have an undeniable sweet tooth—and the mithai market is now going premium. From legacy players like Anand Sweets to a wave of stylish insurgent brands, the race is on to define what “premium mithai” really means. The big question: who will win this battle for India’s sweet indulgence—the many young insurgent brands reimagining tradition, or the incumbents with scale, heritage, and brand power?

My money is on the insurgents? The question is who? I know who I would bet on. IYKYK.

🇮🇳 McKinsey’s Vivek Pandit X The Financial Times’ Veena Venugopal

I first spoke with Vivek more than two decades ago, when he was still based in New York, and I was looking to invest in India. Over the years, we have become friends and often debate where India is heading, why its growth rate always disappoints both the pessimists and the optimists! A must-read for anyone and everyone investing in India.

🍧 Parsi Dairy Farm - a brand I love for its kulfi and paneer

I was happy to see Your Story cover Parsi Dairy Farm. In the six years I lived in Bombay, it was my to-go place for kulfi and paneer. A heritage brand in the truest sense, I enjoyed visiting its original store on Princess Street in Marine Lines. With so many insurgent brands entering the dairy category, including DSGCP’s Epigamia and Go Zero, I hope Parsi Dairy Farm can leverage its heritage and cater to the next generation of Indian consumers. I know that I am the champion of insurgent brands, but we want some of these amazing legacy brands not only to survive but to thrive.

Reply