- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #174: 🇮🇳💆🏻♀️ Indian skincare brands are gearing up to beat global giants at their own game

Deepak's Musings #174: 🇮🇳💆🏻♀️ Indian skincare brands are gearing up to beat global giants at their own game

🎯🧑💼 L Catterton India makes senior hire

I am interested in all aspects of consumer and insurgent brands. In my newsletter, I share what I read, think about, and reflect upon. You can follow me on X at @dishahdadpuri or DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

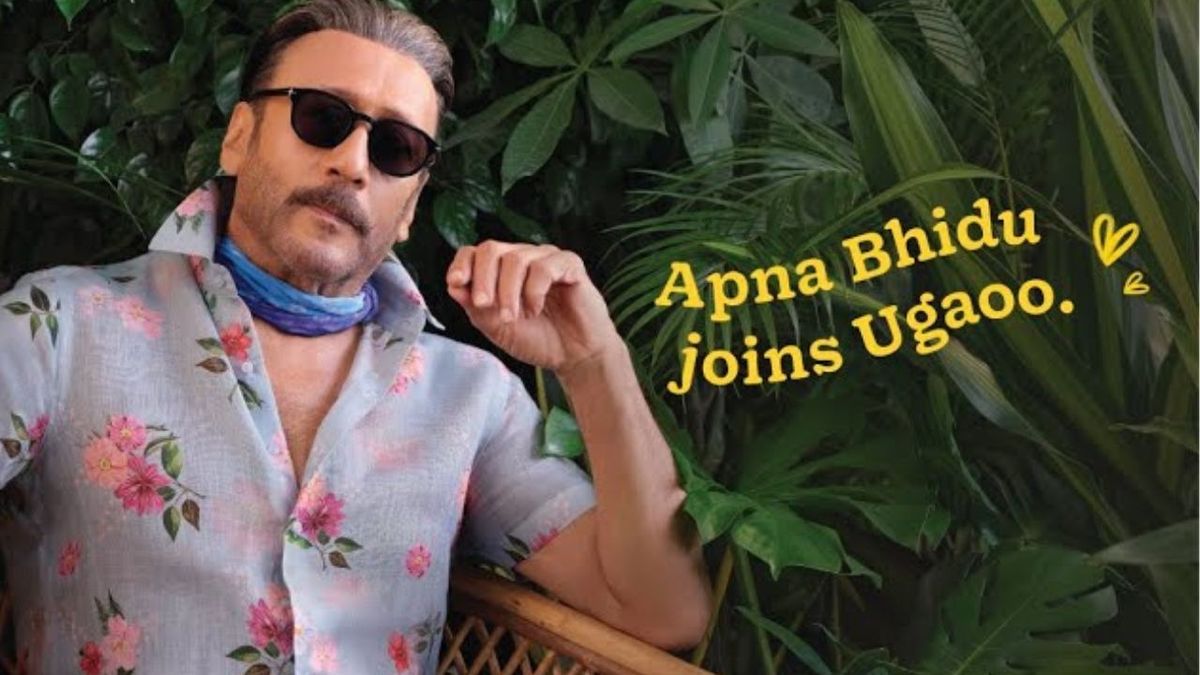

Jackie Shroff X Ugaoo

🎯🧑💼 L Catterton India makes senior hire as India is set to create the next cohort of insurgent consumer brands

Vikram Kumaraswamy joins from Unilever. Based in London, Vikram led global M&A for one of the world’s largest CPG companies.

🦈🍴🐟 Can Minimalist remain relevant under HUL?

When HUL paid ₹2,700Cr for 5% of skincare brand Minimalist, people had feelings. Some worry that HUL will crush Minimalist's scrappy, founder-led vibe. Others point out that the brand's got serious staying power—60% repeat purchases, which is insane for D2C—and think HUL's massive reach could be exactly what Minimalist needs to blow up. The real test? Whether they can keep their "#HideNothing" authenticity while going corporate.

🇮🇳💆🏻♀️🧴Indian skincare brands are gearing up to beat global giants at their own game

After years of chasing global beauty trends, Indian consumers are now turning to homegrown skincare brands that truly get them. Armed with lessons from J-Beauty, K-beauty and Western markets, shoppers want products rooted in local needs, climates, and cultural nuances—without compromising on science or quality. This shift is sparking funding in new brands, with investors betting that Indian-born brands will outshine foreign players in the race to define the country’s next beauty wave, just like it did in China.

🎙️ Deconstruct teams up with Samay Raina and The Rebel Kid

I love this video. Watch it and make up your mind.

🧬 Longevity start-ups

Over recent months, we have seen a rise in startups focused on longevity at DSG Consumer Partners. They vary in size and approach, working on different aspects of longevity such as testing, supplements, coaching, nutritionist interventions, microbiome research, gut health analysis, and more. We are also noticing more BFY (buy Fresh, You) food and beverage brands centred on this theme. The common goal is to improve both lifespan and healthspan—living longer while maintaining health as you age. I am confident that in the coming years, we will support some of these new brands.

This AG1 generation is eager to learn as much as possible about how their bodies age. A number of tests are readily available in the US and Europe, many of which are beginning to enter the markets in India and South East Asia.

✈️ Can brands leverage the growing interest in grocery store tourism

This article captures my recent trip to Tokyo. The entire family kept visiting multiple grocery stores, from Lawsons to “Donki”. We brought back a bag full of Japanese snacks, some of which we had tried before, but many of which we discovered for the first time. It was the same when we visited New York in the summer and Ho Chi Minh last year.

🏍️💨 Q-Comm vs MRP

This story in The Morning Context yesterday got me thinking. As India eagerly embraces Q-Comm, a bigger question looms — could this eventually render the MRP (Maximum Retail Price) obsolete? Editor Ashish Mishra makes the argument that, like the rest of the world, we will see MRP disappear in India.

Context: In India, all goods must display a Maximum Retail Price (MRP) set by the producer, which covers production costs, transportation, taxes, and profit margins for wholesalers and retailers. While retailers cannot sell above the MRP, they can offer discounts and sell below it.

🤲🌱💚 Ugaoo partners with Bollywood legend Jackie Shroff

Watch Jaggu Dada educate Indians on plant parenting:

🍽️➤🧃 Can Indian QSR brands break into CPG?

Starbucks makes 5-7% of its revenue from its CPG products. Can Indian QSR brands create products that can sell across traditional retail channels?

Reply