- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #173: How India spends

Deepak's Musings #173: How India spends

Kraft Heinz announces spin-off of their grocery business

I am interested in all aspects of consumer and insurgent brands. In my newsletter, I share what I read, think about, and reflect upon. You can follow me on X at @dishahdadpuri or DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

🛍️🇮🇳 How India spends?

What does how we spend say about who we are? India’s cities offer a curious map of consumption—Chennai is balanced, Mumbai is lopsided, Kolkata is rising, Bengaluru is shifting. Beneath the numbers: stories of ambition, habit, and change. This isn’t just about rupees and receipts—it’s about urban India in motion.

As insurgent brands expand from their home market to new markets across India, they must look at all aspects of their offering. Like I was told 25 years ago when I started investing in India - India is the same but always different.

Credit for charts and detailed analysis to The Cap-Table.

For the Press Note from the Government of India on the Survey, click here.

🌶️ India has an insatiable appetite for spices

Why are CPG companies, large and small, fighting for a share of India’s spices market? In a recent deep dive, The Ken examines the enticing opportunity that is the spices market and explains the dynamics at play.

Headline stats about the spice market:

India dominates global spice production, accounting for approximately 40–45% of worldwide output by volume. The country produced around 8.1 million tonnes of spices in 2024, representing nearly half of the estimated 18 million tonnes produced globally.

Beyond volume, India's economic impact on the global spice industry is equally significant. The nation generates over one-third of the world's total spice value through its production activities. In 2024, India's domestic spice market reached approximately $12.9 billion, comprising more than a quarter of the global spice market valued at roughly $46 billion.

🔬 Beauty shoppers want science-backed, clinically-proven treatments in a bottle

Beauty is beginning to resemble medicine — from Botox to blood tests and hormone analyses sold as self-care, this article explores how wellness brands use clinical language and techniques to build credibility, tapping into our growing obsession with optimisation. It’s no longer just about improving appearance.

🏘️ Portfolio update: Stayvista

Pranav Maheshwari, co-founder of DSGCP portfolio co Stayvista, joined CNBC TV18’s Startup Street for an exclusive interview on StayVista's growth journey and recent fundraise. He also discussed our 5-year vision to become a ₹1000 Cr hospitality leader, driven by technology and customer loyalty. TLDR: Stayvista is a hospitality-first company with technology at the centre of everything.

Watch the video:

👰🏻💔🧑⚖️ Kraft Heinz announces spin-off of their grocery business

Last week, while I was in Edinburgh, I got a notification that Kraft Heinz was considering spinning off its grocery business — a breakup.

This is happening on the back of the recent spin-off of Kellanova from Kellogg. Since the spin-off, Kellanova is in the process of being acquired by Mars for $36 billion, and now Ferrero is looking to acquire Kellogg for $3 billion. Before the announcement of the spin-off on 29 Sep 2023, the original Kellogg had a market cap of $20 billion. Analysts I spoke to point to this $19 billion of “value creation” as one of the reasons large conglomerate-type CPG companies, including Kraft Heinz, are considering spinning off businesses.

Reflecting on my time as an analyst at Bain & Company, the basic premise of any spin-off, as promoted by investment banks and consulting firms, is that the sum of the parts will be greater than the whole. By examining the share price below, one can only infer the pressure on the board of directors to create value for shareholders. Since the merger, the stock has declined by more than 60%, resulting in a loss of approximately $57 billion in market value.

The share price reflects the poor revenue performance since the original 2015 merger.

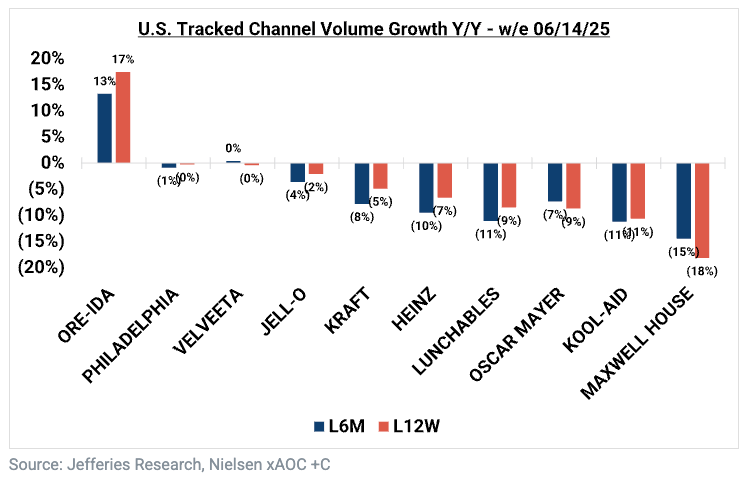

Most of Kraft Heinz’s brands continue to witness YoY volume declines. This graph is from a Jefferies report dated 14 July 2025.

Big CPG companies face numerous headwinds and will keep struggling to adapt to the consumer landscape: inflation, GLP1 drugs, regulation, and more. Additionally, the rise of insurgent brands has been quietly eroding market share; they are gradually growing larger, often at the expense of established players.

📣 Hindustan Unilever and L'Oréal India announce new India CEOs

I am sure this was just a coincidence. Within 10 days, two of India’s largest CPG companies have announced new country heads:

HUL announces Priya Nair as new India CEO from 1 August 2025

L'Oréal India announces Jacques Lebel as new India CEO from 1 October 2025

And not to forget that Manish Tiwary will become CEO of Nestle India from 1 August 2025. This was announced a year ago.

📝 Consumer Trends: 2025 Mid-Year Report

The latest report is now available, covering all 125 pages, so there is plenty to review. As always, this is a US-focused report (I hope this encourages others to research other regions), but many of the trends are already global or have a high chance of becoming global.

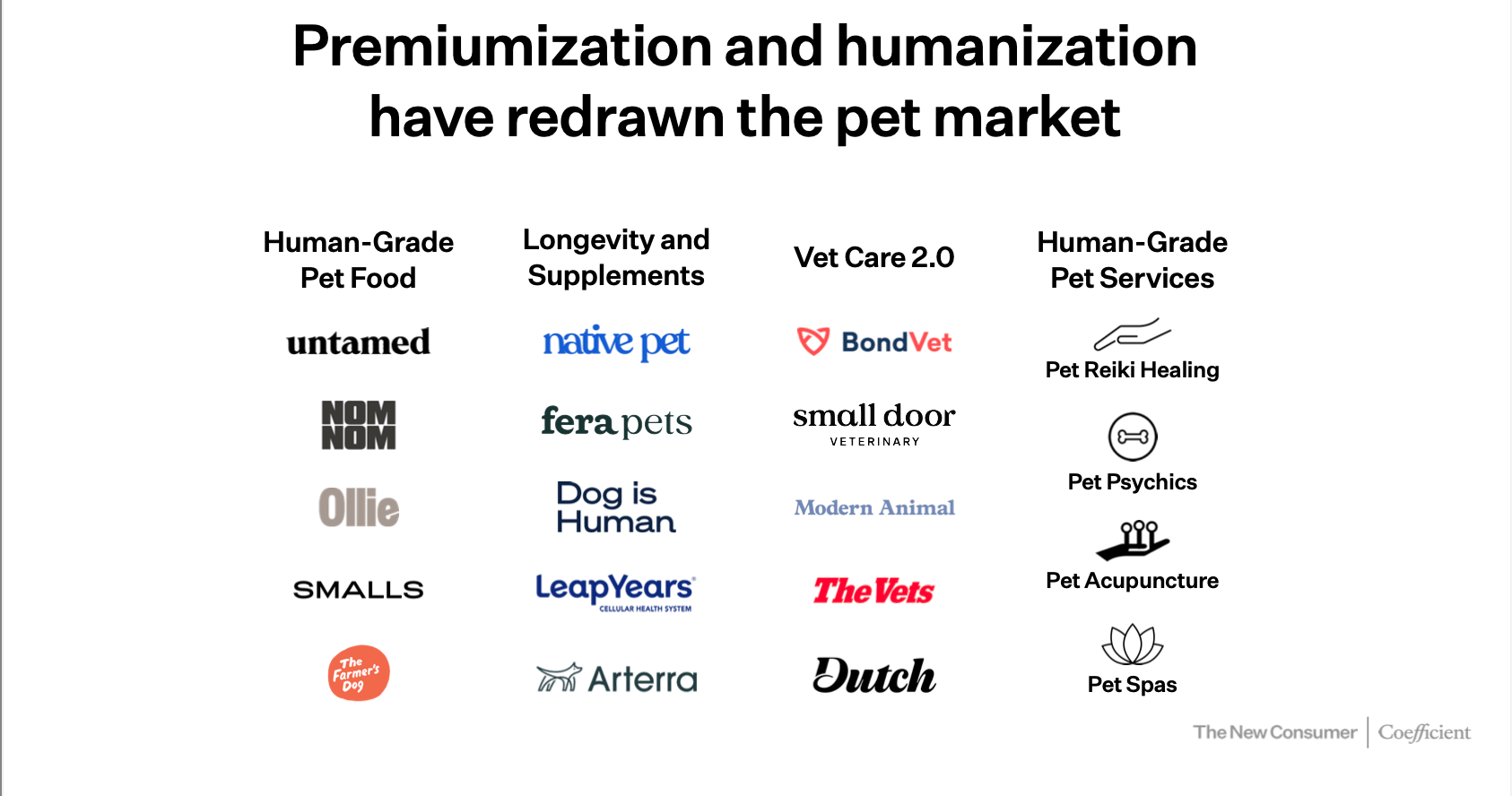

My favourite section is 4, 'The Humanisation of Pets'. Here are two slides that tell you how the pet market is evolving. Very quickly too.

For the full report: Consumer Trends: 2025 Mid-Year Report

I never closely tracked the Akshayakalpa story. So I was surprised by what I learnt from this story in Inc42. From teetering on the edge of a shutdown to scaling a ₹500 Cr, to me, Akshayakalpa's journey is a powerful comeback story rooted in resilience, innovation, and a bold vision for organic farming. It is also a lesson to all insurgent brand founders on how hard it is to build an insurgent brand.

Reply