- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #172: 💸 India continues to stand out as a leader in consumer spending across APAC

Deepak's Musings #172: 💸 India continues to stand out as a leader in consumer spending across APAC

📈 Bessemer: From $30 Bn in 2020 to $300 Bn in 2030 India’s online commerce set to grow 10X

I am interested in all things consumer and insurgent brands. In my newsletter, I share what I read, think about, and reflect upon. You can follow me on Twitter at @dishahdadpuri or DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

A slide from Bessemer Venture Partners report “Click, Watch, Shop: The Consumer Opportunity in India”

💸 India continues to stand out as a leader in consumer spending across APAC

I have been on the road for the last 4 weeks meeting LPs in the USA and Europe. Meeting after meeting, LPs were clearly excited by the Indian consumer story. A recent McKinsey Asia Pacific consumer sentiment survey highlights Indian consumers intention to splurge intention to splurge.

📊 More insurgent brands in the funnel for IPOs

Verlinvest, one of India’s leading backers to insurgent consumer brands, sees more insurgent brands that have crossed 1,000 Crs (US$115 Mn) potentially look to IPO over the coming years. I have had the privilege of working with the Verlinvest team since 2009, when they first invested in Sula Vineyards, which was the first IPO from the DSGCP portfolio. As more consumer brands emerge and become market leaders, founders will debate longer-term strategies, ranging from considering an IPO to trade sales to strategics. Some will also cede control to larger PE and buyout funds and roll up other brands. Exciting times for insurgent brand founders.

📈 Bessemer: From $30 Bn in 2020 to $300 Bn in 2030 India’s online commerce set to grow 10X

A new report from Bessemer — “Click, Watch, Shop: The Consumer Opportunity in India” — unveils a $1 trillion digital potential fueled by mobile-first consumers, affordable data, seamless payments, and AI-powered platforms. From ultra-fast q‑commerce to aspirational D2C brands, regional content and booming micro‑transactions, the next wave of India’s consumer revolution is a powerful fusion of commerce, content, and rising consumer expectations. Whether you're a founder, operator, investor, or anyone in the consumer ecosystem, this report lays out the tailwinds, terrain, and metrics that will define India’s digital future — and why right now is the perfect moment to tap in.

Slide from BVP’s report. Highlights select D2C* brands in select categories.

*

Please note that many of these brands are NOT direct-to-consumer as they sell across multiple channels.

💊 Can a supplement brand take wellness inside out? Olly thinks it can.

Everyone knows Olly, a household name for vitamins that Unilever acquired. Olly has inspired many wellness and supplement businesses worldwide, including in India and Southeast Asia.

What is more interesting for me is their latest play - taking wellness inside out with the launch of BPC products. Will it work?

🟢 Portfolio update: Rabitat

This is one of many follow-on investments we closed at DSG Consumer Partners last month.

First up is Rabitat, where we are writing our second cheque. Founded by brothers Sumit and Siddharth Suneja, Rabitat is reimagining kids' foodware and drinkware with BPA-free, globally certified, and design-led products that modern parents trust. We love backing founders solving real consumer pain points with product-first thinking and disciplined execution. Rabitat is building for informed parents who care deeply about what touches their child’s food by prioritising safety, durability, and thoughtful design.

👵🏼 Portfolio update: Aire helping you live with dignity

We are also doubling down at Aire, which is redefining how incontinence care is designed and delivered to Asia’s ageing population. I remember my first meeting with Nivedita Venkateish, listening to her vision for Aire, and taking on the giants in a sleepy category with stigma. I had recently become acquainted with the category as people close to me started using similar products as they grew older. It has been such a joy to see the business germinate from its seed and now to see it slowly grow.

🏘️ Portfolio update: StayVista continues to build India’s premium hospitality brand

DSGCP is backing StayVista for the third time. Since our first investment in 2020, Ankita Sheth, Amit Damani, and Pranav Maheshwari have navigated the COVID's hospitality disruption with exceptional grit and execution discipline. Their proven resilience through the industry's toughest period reinforces our confidence in the team and vision.

Anyone who has stayed at a StayVista property knows what I mean when I say StayVista is building India's premier hospitality brand that curates every touchpoint of the luxury vacation experience, from handpicked villas to personalised service that transforms getaways into unforgettable escapes. And if you have not stayed at a StayVista property, I can only feel sorry for what you are missing.

📣 CPG IPO Watch: Wakefit

Insurgent brand Wakefit just filed its DRHP. With FY25 revenues at around 1,250Crs (US$145 Mn), the company is one of the leading brands in the home category. It will be interesting to see how the market prices this, but I understand that bankers are indicating a range between 6,000-8,000Crs (US$ 700-925 Mn).

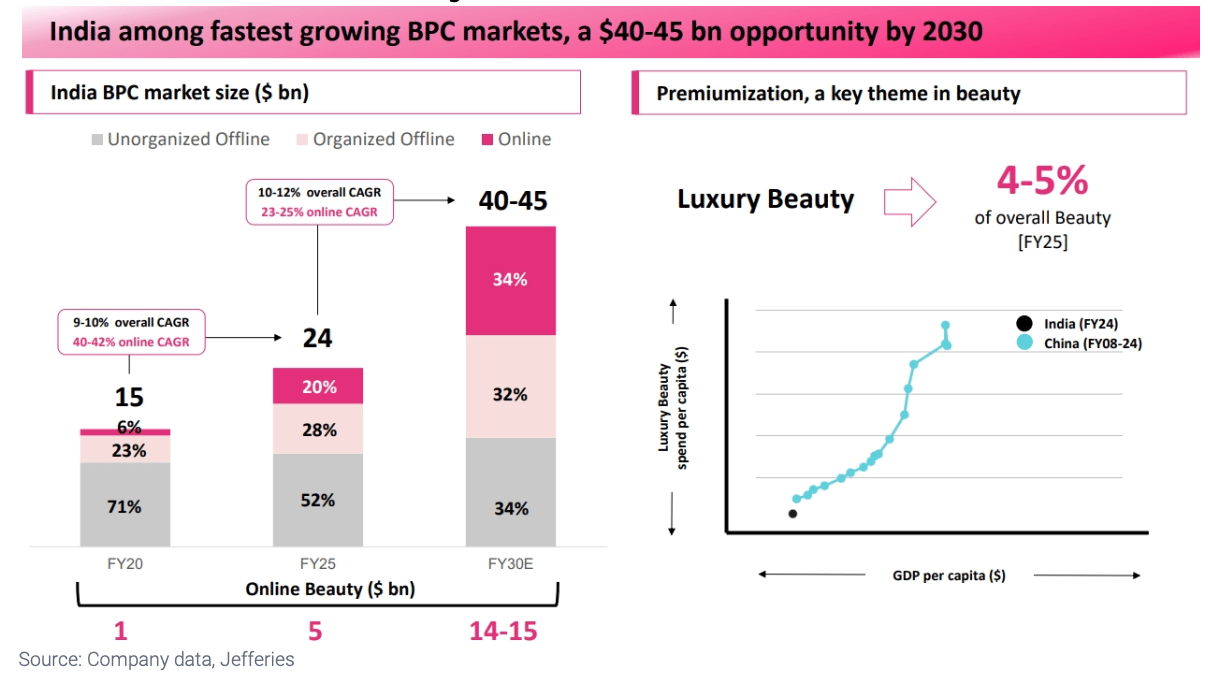

💄India’s BPC market to touch $40-45Bn by 2030

I wanted to share this chart from a recent report by Jeffries. This is why we at DSG Consumer Partners are focused on BPC as one of our key sectors, particularly in the masstige/masspremium and luxury segments of BPC. And online to account for 35% of the market!

Reply