- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #166: 🪞Do Indians want to be "fairer"?

Deepak's Musings #166: 🪞Do Indians want to be "fairer"?

🔮 The 2025 Forecasts and Trend Reports

I am interested in all things consumer and insurgent brands. In my newsletter, I share what I read, think about, and reflect upon. You can follow me on Twitter at @dishahdadpuri or DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

Why We Partnered with Indus Valley: Revolutionizing Cookware for India's New Generation

🪞 Why do Indians want to be “fairer”?

Emami's decision to drop "Fair" from its flagship men's product hasn't just changed a name; it reopens a decades-old painful debate about India's deep-rooted desire to be “fairer” and not darker. Does this rebranding from "Fair and Handsome" to "Smart and Handsome" come as younger Indians wage war against their parents' generation's obsession with fair skin, a contentious beauty standard that critics argue reeks of colonial hangover and internalized racism?

Emami frames this as a progressive pivot. The ₹32,000 crore male grooming market now sits at a crossroads, with some industry veterans warning that abandoning fairness claims could alienate millions of loyal customers who still secretly yearn for lighter skin, even as they publicly embrace diversity.

⚔️ Yes, the rise of insurgent brands is challenging the incumbents!

The incumbents need to and will continue countering the insurgents. What have we learnt from evolution? Things change. Not so long ago, today’s incumbents were the insurgents, but tomorrow’s incumbents will be today’s insurgents.

🔮 The 2025 Forecasts and Trend Reports

Analysts and futurists look at the crystal ball and predict. Here are some of the many 2025 consumer-related forecasts and trends. I have selected the few I found most interesting.

The first provides the macro backdrop for what to expect in 2025. Apollo Chief Economist Torsten Sløk always does a super job of analyzing data and extracting insights.

🛵💨 “Earlier, I used to open the fridge. Now, I open Instamart” - Has QCom rewired our brain?

Beyond the convenience of these 10-minute deliveries, some experts argue, lurks a fascinating psychological shift that's rewiring our brains in ways that mirror our most addictive social media habits. As experts sound the alarm about vulnerable groups and vanishing buyer's remorse, this story from The CapTable peels back the curtain on how the instant gratification economy isn't just changing what we buy—it's fundamentally altering how our brains process desire, satisfaction, and the very notion of waiting itself.

(C) The CapTable 16 Jan 2025

Full story here:

🥘 Why We Partnered with Indus Valley: Revolutionizing Cookware for India's New Generation

In the heart of India's homes, a quiet revolution is simmering—and it's transforming how India cooks. As India's middle class trades up from traditional kitchenware, they're seeking more than just pots and pans; they're demanding cookware that marries ancestral wisdom with modern innovation. This shift in a fragmented ₹40,000 crore market led us to Indus Valley, a brand reimagining the soul of Indian cooking through thoughtfully designed, health-conscious cookware. In their vision, we saw our next chapter—helping shape the future of Indian kitchens, one perfectly crafted vessel at a time.

This is why DSG Consumer Partners is excited to announce our follow-on investment in The Indus Valley.

💆🏻♀️🧴 Why We Partnered with Deconstruct: Building India’s Most Loved, Highly Effective yet Gentle Skincare Brand

DSG Consumer Partners is thrilled to announce our investment in Deconstruct, a brand born from that question. Our journey with Malini Adapureddy began three years ago, when she was dismantling skincare myths through an Instagram community. While others pitched their wares from opposite corners—natural brands wrapping themselves in the comfort of tradition, science-backed lines brandishing clinical trials—Malini saw the gulf between them as an opportunity. She envisioned a middle path: 𝐬𝐤𝐢𝐧𝐜𝐚𝐫𝐞 𝐭𝐡𝐚𝐭 𝐦𝐚𝐫𝐫𝐢𝐞𝐝 𝐥𝐚𝐛𝐨𝐫𝐚𝐭𝐨𝐫𝐲 𝐩𝐫𝐞𝐜𝐢𝐬𝐢𝐨𝐧 𝐰𝐢𝐭𝐡 𝐬𝐤𝐢𝐧-𝐥𝐨𝐯𝐢𝐧𝐠 𝐠𝐞𝐧𝐭𝐥𝐞𝐧𝐞𝐬𝐬. Under Malini's steady hand, Deconstruct didn't just grow—it soared, achieving a stunning 10x growth in the past year while maintaining something rarely seen in the startup world: profitability. Her methodical, brick-by-brick approach to scaling resonated deeply with our philosophy of building enduring brands. Now, we're honoured to partner with Malini and her team in their quest to build India's most beloved skincare brand. The journey becomes even more exciting as we join forces with our long-standing partners V3 Ventures and BOLD, the venture fund of L’Oréal, while building alongside BEENEXT and Kalaari Capital. Together, we're not just investing in a company—we're investing in a future where effective skincare doesn't come at the cost of skin health.

💰 Breaking News: HUL Acquires Minimalist

I was about to publish this newsletter when I read the official announcement that Hindustan Unilever (HUL) is acquiring Minimalist. This is big news for the insurgent brands’ story in India. Congratulations to the investors: Peak XV and Unilever Ventures.

I will review this in my next newsletter.

🧳 Case study: The story of LVMH

This is a must-read for anyone interested in what it takes to build luxury brands.

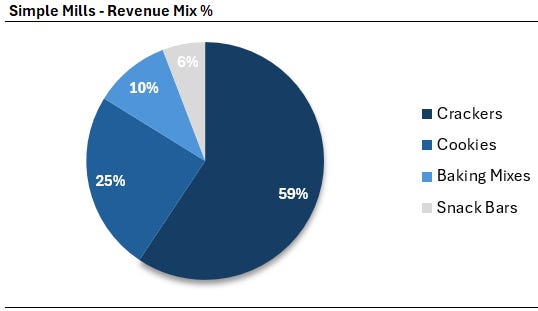

🍞 Case study 2: Bakery disrupt Flower Foods acquired cleaning snacking company Simple Mills

Simple Mills does lead the clean snacking category with a and has widened their distribution somewhat, Target was one of those step ups I think. Flower has disrupted the bakery category with Canyon GF and Dave's Killer Bread in quite an irreverent way. Interestingly, this does give them cross-category reach and helps to premiumise their share of the wallet.

Reply