- Musings From Deepak @ DSG Consumer Partners

- Posts

- Deepak's Musings #162: 🛒 Will established CPG companies like HUL defend their market position against insurgents?

Deepak's Musings #162: 🛒 Will established CPG companies like HUL defend their market position against insurgents?

🍦 A sweet dive into India’s ice cream industry

I am interested in all things consumer and insurgent brands. In my newsletter, I share what I read, think about, and reflect upon. You can follow me on Twitter at @dishahdadpuri or DSG Consumer Partners at @dsgcp.

p.s. You can click any summary link to read the full article from its source.

The Insurgents Are Here

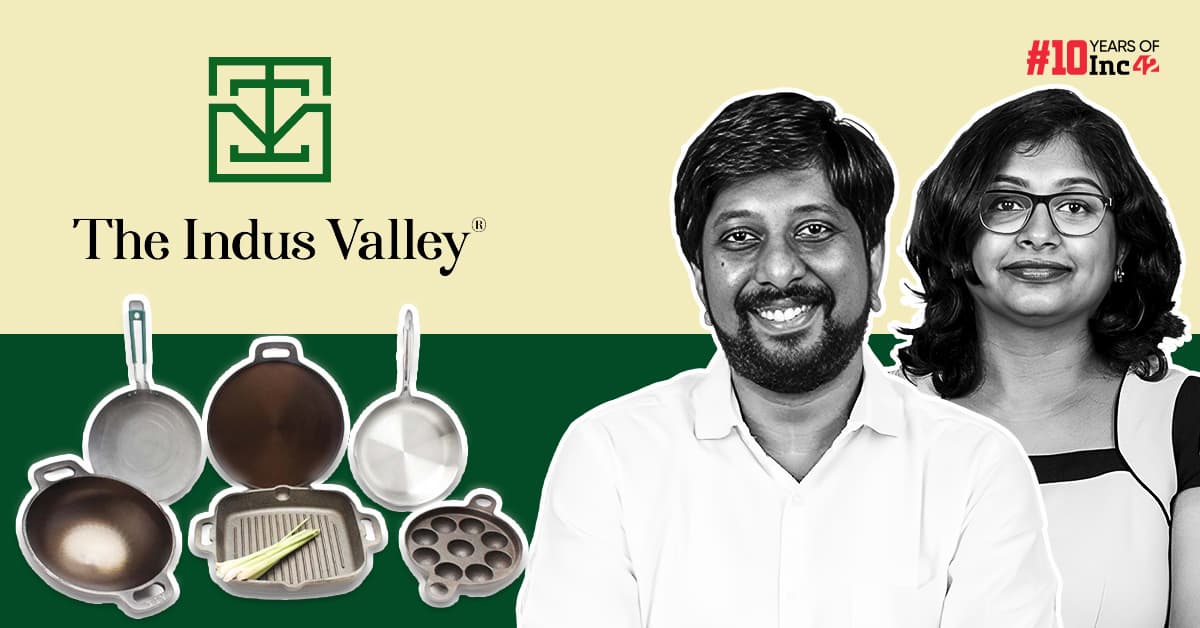

🍳 The Indus Valley closes new funding

At DSG Consumer Partners, we are passionate about partnering with mission-driven founders to build the next generation of insurgent brands. We first met Madhumitha and Jagadeesh in 2021 and instantly knew we wanted to partner with these two amazing founders on their journey to build one of India's leading kitchenware brands. We are happy to continue this journey three years later as the company scales.

🍦 India’s ice-cream industry 101

India's ice cream industry is experiencing rapid growth, driven by a burgeoning middle class, rising disposable incomes, and the convenience of quick commerce platforms. Despite a per capita consumption of just 1.6L (FYI, New Zealand is at 28L), experts project the market could reach ₹50,000 crore by 2028. Both incumbents like Amul and insurgents like Go Zero are capitalizing on this trend, blending traditional flavours with modern innovations to cater to evolving consumer preferences. Dive into the factors propelling this sweet surge and discover how India's ice cream landscape is transforming.

Hindustan Unilever (HUL) is strategically restructuring its beauty and personal care division. This move reflects HUL's response to evolving consumer preferences and the dynamic landscape of India's CPG sector. By aligning its organisational structure, HUL aims to enhance its agility and maintain its leadership in the industry. This narrative is consistent with its recent announcement to divest its ice cream business, which was a relatively low-margin contributor.

Is there a danger that poorer consumers will be increasingly underserved as companies focus on premium categories?

🛒 Will established consumer goods companies like HUL defend their market position against insurgents?

Following on from the piece above. While HUL can and should intensify its competitive response, I believe its realistic goal is to protect its existing market position rather than expand it. The momentum appears to be with the insurgent brands.

👕 Coolmate: building a proudly Vietnamese menswear basics brand

DSG Consumer Partners first invested in Vietnam’s Coolmate in May 2022. It recently closed a new round with Singapore’s Vertex Ventures. We are excited about the prospects of insurgent brands in Vietnam and believe that founder Pham can build a substantial business over time. We do not need to make a unicorn to create a great company.

🏠 Case study: Livspace

India is getting richer, and Indians are spending with more money in their pockets. One area where Indians are increasing their spending is their home. DSG Consumer Partners is excited about this category and has invested in some insurgent brands, including Sleepy Cat, The Indus Valley, and Ugaoo.

Home renovation is a huge market, and anyone who owns a home knows how difficult it is to get work done. It is fragmented and messy, and contractors are challenging to manage. Livspace was founded to solve this problem. As a customer, I used Livspace to renovate my home in Singapore in 2023. If not a perfect experience, I was impressed by many aspects of the service and product delivery. Livspace is trying to solve a very hard problem. This takes time and a lot of smart people.

I have spent time with co-founder Anuj and have been impressed by his thinking and what he has built to date. I wish him and his team all the best because we need a painless home renovation solution. It is a problem looking for a solution!

🍫 Mondelez ❤️ Hershey?

After the Mars ❤️ Kellanova love story, is the next fairy tale romance going to be Mondelez ❤️ Hershey? With over 90% of Hershey’s revenue coming from the USA, this move only makes sense to increase Mondelez’s US market share. Remember, Mondelez did propose to Hershey 8 years ago, only to be rebuffed. Second time lucky?

🛍 The future of India’s consumer market, as seen by Harsh and Rishabh Mariwala

Discover how Harsh Mariwala, Chairman of Marico, and Rishabh Mariwala, founder of Sharrp Ventures, are navigating the rapidly evolving business landscape by tapping into emerging trends like premiumization, the rise of D2C brands, and the game-changing potential of Qcom.

And just for the record, the term D2C is misused in this article, especially in the context of Honasa. D2C is direct to the consumer. Honda is not a D2C brand, although it may have started as one. It is now an omnichannel brand that sells through distributors, which is one of the reasons for the recent issues. My definition is simple: if you sell director to the consumer, online or offline, you are D2C. You are no longer direct if you sell via distributors, wholesale, marketplaces, etc. And that is not a bad thing!

Consumer funding and deal news that caught my attention

Reply